The Standing Deposit Facility (SDF) is a collateral-free liquidity absorption mechanism introduced by the RBI to absorb excess liquidity from the banks by providing an interest payment. There are several mechanisms already used by the RBI to withdraw excess liquidity in the banking system and the popular one was the reverse repo. The unique feature of SDF is that it is a collateral free liquidity absorption mechanism to absorb liquidity from the commercial banking system into the RBI. Collateral free means the RBI will not give any collateral like G-Secs while bank gives funds to the RBI. Government in the Budget’s (2018) Finance Act included a provision for the introduction of the Standing Deposit Facility (SDF).The SDF was introduced on April 8, 2022.

What is Standing Deposit Facility (SDF)?

Standing Deposit Facility allows the RBI to absorb liquidity (deposit) from commercial banks without giving government securities in return to the banks. In the present situation, the main arrangement for the RBI to absorb excess money with the banking system is the work-horse reverse repo mechanism. Under reverse repo (which is a part of the Liquidity Adjustment Facility), banks will get government securities in return when they give excess cash to the RBI. An interest rate of reverse repo rate is also provided to banks.

Basically, the SDF was introduced by the RBI as an overnight facilty, implying that banks can park funds with the RBI for one day. Still, the RBI may introduce longer term SDF tenures.

Table: Features of Standing Deposit Facility

| Feature | Description |

| Launched on: | April 8, 2022. |

| Objective | Liquidity absorption from banks |

| Nature of working | The RBI absorbs liquidity from banks, as the banks parks their excess funds with the RBI and gets an interest from the RBI. |

| Tenure/duration | SDF is a one-day facility. But the RBI has the right to introduce longer term SDF with suitable interest rate, when the need arises. |

| Availability | The SDF is available on all days, sundays and holidays- available between 17:30 hrs to 23:59 hrs. |

| Financial institutions who can avail the facility | All Scheduled Commercial Banks (including Regional Rural Banks), Small Finance Banks (SFBs), Payments Banks, Local Area Banks (LABs), Primary (Urban) Co-operative Banks (UCBs), State Co-operative Banks (StCBs) and District Central Co-operative Banks (DCCBs). |

| Interest rate | The interest rate at present is below the repo rate. The SDF interest rate will be set by the RBI from time to time. |

| Unique feature | SDF is Facility is collateral free. Thus, banks will not get any collateral in return when they parks their funds with the RBI. On the other hand, most other facilities by the RBI necessitates provision of collateral (mostly G-secs) by the counter party. |

| Collateral | No collateral is needed |

| Mode of application | RBI’s e-Kuber system. |

| Any other feature | The SDF replaced the fixed rate reverse repo (FRRR) as the floor of the LAF corridor. SDF should not be considered as balances eligible for the maintenance of CRR, but will be eligible to be counted under SLR. |

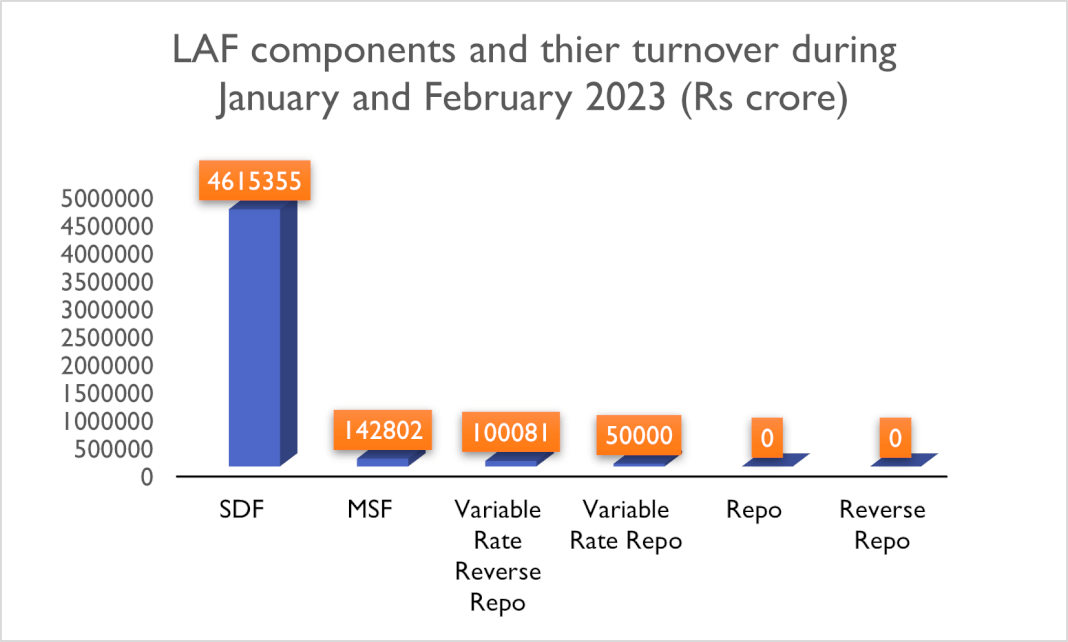

The picture here shows the importance of SDF. Frequency of SDF transactions were high during Janauary and February 2023 which shows the importance of SDF as a liquidity operation under LAF.

The SDF has interest rate of 6.25%, implying that banks who are making deposits with the RBI under SDF will get the interest rate of 6.25%. This rate may change with policy decisions of the RBI.

Related Article: Difference between Marginal Standing Facility and Standing Deposit Facility.

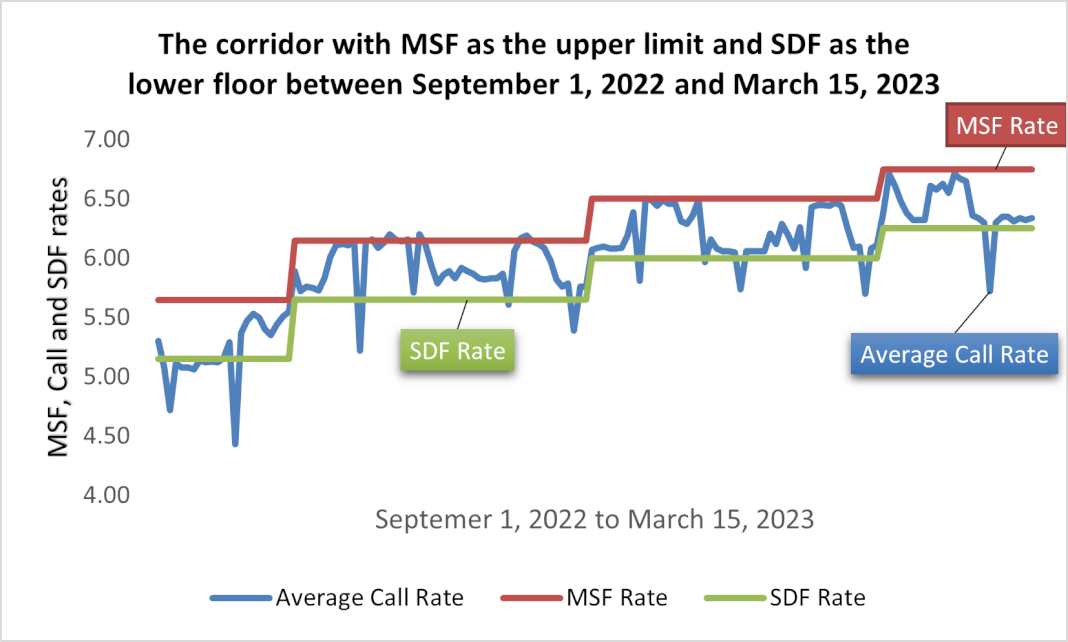

An important as well as interesting feature of SDF is that it will replace the Fixed rate Reverse Repo at the floor of the LAF corridor. This means that the call rate should ideally move between the SDF rate on the lower floor and the MSF rate on the upper floor.

The inconvenience with this arrangement is that the RBI has to provide securities every time when banks provides funds.

As per the stand of the RBI, when the central bank has to absorb tremendous amount of money from the banking system through the reverse repo window, it will become difficult for the RBI to provide such volume of government securities in return. This situation was occurred during the time of demonetisation.

In this sense, the Standing Deposit Facility (SDF) is a collateral free arrangement meaning that RBI need not give collateral for liquidity absorption. The SDF will allow the RBI to suck out liquidity without offering government securities as collateral.

Features of Standing Deposit Facility (SDF)

- The Standing Deposit FacilityThe SDF would replace the Fixed Rate Reverse Repo (FRRR) as the floor of the LAF corridor.

- The SDF rate will be 25 basis points (bps) below the policy repo rate.

- The SDF is an overnight liqudity absorption facility and there is flexibilty for the RBI to increase the tenure.

- All entities that are eligible for LAF can use the SDF facility.

- Working time: An important feature of the SDF is that like the MSF, the SDF will be available on all days, including sundays and holidays.

- The rate of interest will be decided by the RBI from time to time and at present, it is kept 25 basis point lower than the policy repo rate.

- SDF operations will be conducted on the RBI’s e-Kuber system, working through the electronic mode.

Importance of the SDF is that it is designed to enable the Reserve Bank to deal with extraordinary situations in which it has to absorb massive amounts of liquidity. In the past situations like global financial crisis and demonetisation caused liquidity absorption problems for the RBI.

Under the existing liquidity framework, liquidity absorption through reverse repos, open market operations and the cash reserve ratio (CRR) are at the discretion of the Reserve Bank. But SDF will enable banks to park excess liquidity with the Reserve Bank at their discretion.

As a standing facility, the SDF supplements Marginal Standing Facility or the MSF (SDF for liquidity absorption whereas MSF for liquidity injection).

Difference between Standing Deposit Facility, Reverse Repo and MSF

Within the existing liquidity management framework, liquidity absorption through reverse repos, open market operations and the cash reserve ratio (CRR) are at the discretion of the Reserve Bank. On the other hand, the use of standing facilities (MSF, SDF) would be at the discretion of banks.

The difference between the Standing Deposit Facility and Reverse Repo is that there is no need for collateral under the SDF.

According to the Finance Act that made the launch of SDF, a separate clause shall be inserted in the RBI Act: “The accepting of money as deposits, repayable with interest, from banks or any other person under the Standing Deposit Facility Scheme, as approved by the Central Board, from time to time, for the purposes of liquidity management…”

The proposal was first suggested by the Urjit Patel Committee in its recommendation of the Monetary Policy Framework in 2014.